Welsh farming unions have responded to ‘limited changes’ in the so called farm tax announced by Chancellor Rachel Reeves in today’s budget.

In her Budget, the Chancellor announced a change to the rules which will allow those farmers who are married, or have deceased spouses, to transfer their inheritance tax allowance to one another if one of them dies having not used their allowance.

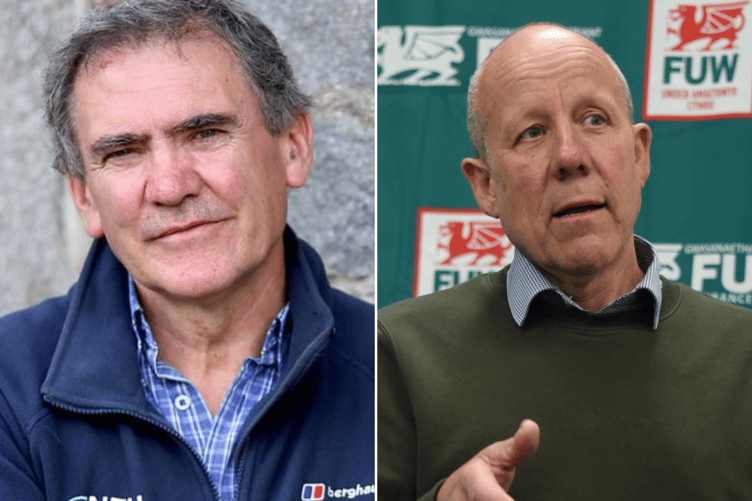

The union believes this change doesn’t go far enough, nor will it alleviate the serious impact of the tax on the elderly and terminally ill with NFU Cymru President Aled Jones describing the announcement as a ‘limited change’ to a damaging and destructive tax

Mr Jones said: “I acknowledge the change announced today will help a limited number of farmers, but it does not mitigate the devastating impact of this policy for many.

“In making this change the UK Government is essentially recognising that mistakes have been made in the way in which this policy was designed. I welcome the fact that they appear to be acknowledging these errors, but the step they are taking does not go nearly far enough to reduce the damage that this policy will do to Wales’ family farms, our rural communities, Welsh language and culture.

“Over the last 12-months or so some truly heart-breaking accounts have been shared with me of elderly farmers or those diagnosed with terminal illnesses, who have in good faith arranged their affairs on the basis that their estates would not be subject to inheritance tax. These farmers now find themselves caught in the crosshairs of this policy with no time left for them to make alternative succession arrangements. This acute impact on the elderly and terminally ill remains a huge concern, and for them, in particular, we keep fighting.

“Yesterday, on the eve of the Budget we saw hundreds of visitors to the Royal Welsh Winter Fair gladly playing their part in sending a message to the Chancellor. The visual display saw participants hold up tiles to form a mosaic spelling out a clear ‘NO IHT’ message to the Chancellor. This signalled the strength of feeling that exists in the farming and rural community, as well as amongst the businesses that rely on them, over the UK Government’s planned changes to inheritance tax reliefs.

“Earlier this month, the House of Commons’ Welsh Affairs Committee also reported back on inheritance tax as part of its wider enquiry into Farming in Wales. The report of that cross-party committee was unanimous in recommending to the UK Government that they delay the APR and BPR reforms until a Wales-specific impact assessment has been published and scrutinised by the committee. I echoed and endorsed that call to UK Government a fortnight ago and I make it again now in light of today’s limited change, which does not go far enough in terms of addressing the impact of the Government’s policy.”

Mr Jones concluded with a thank you to all those who have supported the union’s efforts over the last 13-months: “I owe a huge debt of gratitude to NFU Cymru members, rural businesses and members of the public who have supported our efforts so far in ensuring the sector’s voice is heard loud and clear. I also want to extend a particular thanks to backbench MPs of all parties who have spoken out against the policy and lobbied hard for a change. We will continue to work with this large group of Parliamentarians who recognise that the policy the government has chosen is wrong.”

The President of the Farmers’ Union of Wales (FUW), Ian Rickman said the union has repeatedly warned that the reforms, due to come into force next April, represent an existential long-term threat to Welsh family farms and the wider rural economy.

He said the Chancellor has today committed to making the Government’s proposed relief for the first £1 million of agricultural and business assets transferable between spouses - a measure repeatedly called for by the FUW - but failed to change course on wider reforms to inheritance tax, meaning many farming families risk facing unaffordable tax bills to inherit the family business.

Commenting, FUW President Ian Rickman said: “Over the past year, the Farmers’ Union of Wales has repeatedly called on the UK Government to reconsider its approach to inheritance tax reform, and has offered practical and credible alternatives.

“From the outset, we have consistently advocated for all tax-free allowances to be fully transferable between spouses, as an absolute minimum measure to safeguard family farms and protect the wider rural economy from irreversible harm.

“The Chancellor’s commitment today to implement this change is therefore a step in the right direction, and one that will help ease the challenges of succession planning for many farming families.

“It is also encouraging to note that the lifetime gifting rules remain unchanged - a mechanism the Union had urged the Treasury to preserve.

“However, her decision to press ahead with the government’s broader proposals for inheritance tax reform remains deeply disappointing, if unsurprising. These changes still risk causing lasting damage to rural communities.

“It is not too late for MPs to support further changes to this unfair and poorly targeted policy. We will keep making the case in Westminster and beyond to protect the future of Welsh family farms. We would urge MPs from all parties to back any amendment to the Budget that would ensure family farms can be passed on with confidence to the next generation.”

Comments

This article has no comments yet. Be the first to leave a comment.